Sample Template Example of Notes On Deferred Tax in Word / Doc / Pdf Free Download

Download Format

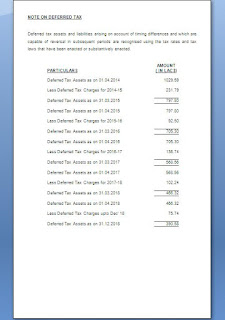

NOTE ON DEFERRED

TAX

Deferred tax

assets and liabilities arising on account of timing differences and which are

capable of reversal in subsequent periods are recognised using the tax rates

and tax laws that have been enacted or substantively enacted.

PARTICULARS

|

AMOUNT

( IN LACS)

|

Deferred

Tax Assets as on 01.04.2014

|

1029.59

|

Less

Deferred Tax Charges for 2014-15

|

231.79

|

Deferred

Tax Assets as on 31.03.2015

|

797.80

|

Deferred

Tax Assets as on 01.04.2015

|

797.80

|

Less

Deferred Tax Charges for 2015-16

|

92.50

|

Deferred

Tax Assets as on 31.03.2016

|

705.30

|

Deferred

Tax Assets as on 01.04.2016

|

705.30

|

Less

Deferred Tax Charges for 2016-17

|

136.74

|

Deferred

Tax Assets as on 31.03.2017

|

568.56

|

Deferred

Tax Assets as on 01.04.2017

|

568.56

|

Less

Deferred Tax Charges for 2017-18

|

102.24

|

Deferred

Tax Assets as on 31.03.2018

|

466.32

|

Deferred

Tax Assets as on 01.04.2018

|

466.32

|

Less

Deferred Tax Charges upto Dec' 18

|

75.74

|

Deferred

Tax Assets as on 31.12.2018

|

390.58

|

Download Format

0 comments:

Post a Comment